Our portfolio updates for the week ending on December 27, 2024 are as follows.

The New Brokerage High Yield Savings

You know how we’re always talking about moving any cash you have sitting around into BulletShares so your money’s not sitting around making money (or losing buying power due to inflation)? Well listen up, cuz we’ve got some cray cray news for you!

We sold all of the BulletShares in both portfolios, but not to buy anything new. I found something similar to these cash generators but pays a higher yield. It’s ticker is THTA and it’s a fund of options back by treasuries.

Instead of the 7% BulletShares were giving us, THTA yields 12% and has the same small price band and limited downside. 🤯 Yeah… that’s why we’re using this as our cash fund now.

Mo divies, mo dollars!

So in the Van Life Portfolio we sold half of our position in PHT for a minimal 2% gain to put this money into THTA. PHT yields 8.5%, but it’s not as good at THTA’s. More reward for less risk… pfshht, that’s a no-brainer.

A Bold Swap

We sold a few shares of HTGC (26), MAIN (9) and RYLD (91) to free up some capital. Why? I’m glad you asked…

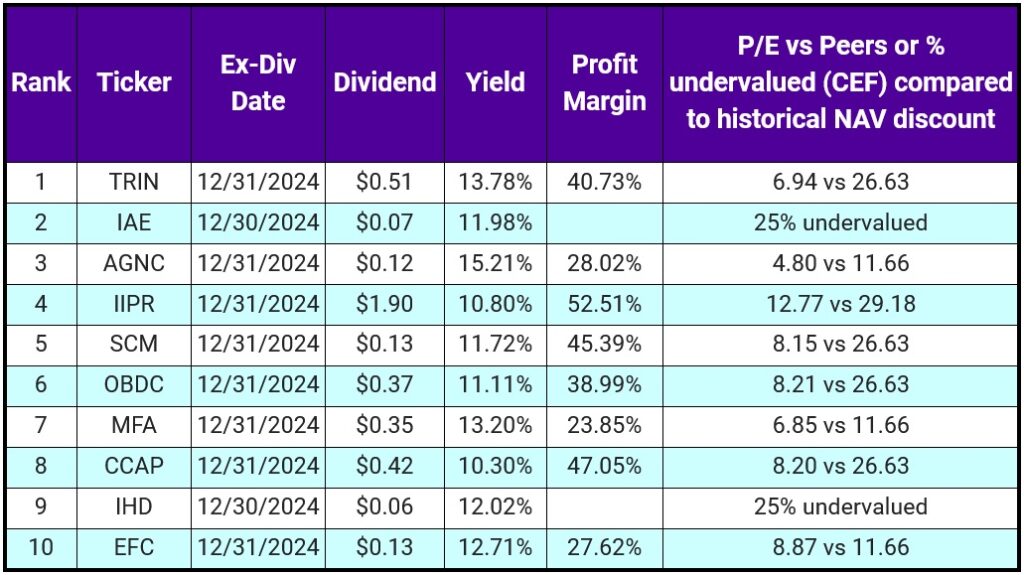

If you’re on our weekly email, you would’ve seen that IIPR is one of our top pics for the week and is super undervalued right now. Yes, there was bad news, but IIPR is still a great company.

The stock dropped like 40% because one of their tenants defaulted on their lease. That tenant only accounts for 14% of IIPR’s revenue, so a price drop that big is absurd.

If you have the money, I’d seriously consider picking this one up as it now yields 10%. To put that in perspective, I thought IIPR was hot shit when it yielded 7%.

We couldn’t pass up buying into the irrational fear of other investors. But in order to do that, I had to sell shares of my babies MAIN and HTGC. Hello!! Earth to Matilda, you gotta know I have to feel some kind of way about IIPR to do this.

(FYI we never had IIPR in our van portfolio because of the high price, but it’s been in the conservative portfolio for a while.)

This was a very hard decision. There never seems to be enough money to go around. But moves like this usually pay off when irrational sentiment pivots. We’ll let you know when it does.

Want Portfolio Updates Sent Right To Your Inbox?

We post updates about our portfolios each week, but if you’re worried about missing this time sensitive information, get on our free Investing IINsights email list. You’ll also get market updates and Tim’s top hand picked investment ideas.