Tim and I both hate spam and getting email bombed, so that’s not something you’ll ever see from us. You get 1 email every Friday morning right around market open.

Since our profits and payouts are higher when we keep up with stocks on the watch list, economic news, and macro trends, Tim puts in the time to stay aware.

He recommends you do this yourself so you can be self sufficient. But for those of you who are more like me and have bandwidth issues because of everything else you’re doing, you can rely on Tim to fill you in.

If you sign up, you’ll get 3 different things in each Investing IINsights email.

Market And Economic Updates

Our emails usually start with a section on relevant updates and/or news about the overall economic climate and how that relates to the stock market.

This is usually a bunch of numbers from the various reports that come out all the time. It can seem like gibberish at first, but you’ll start to notice what the metrics mean and how they can impact things.

Tim’s really good about only relaying the relevant pieces to our investing strategy and highlighting what that information means and what to keep an eye out for in upcoming reports.

Macro trends, sector strength, technology developments, and market direction (investor sentiment) all factor into Tim’s insights and what he decides to do with our portfolios

Tim’s Top 10 IINvestment Going Ex-Dividend Next Week

You make more money when you buy stocks that are undervalued both from price appreciation and higher dividend payouts from getting more shares for your investment.

Tim’s always doing research and running stock screeners to help him monitor the value of stocks in our portfolios and find better investment opportunities.

He noticed that most “top stock” lists don’t provide anything useful. They either focus on overvalued growth stocks and Aristocrats or the highest yielders without qualifying them (aka unjustified risk).

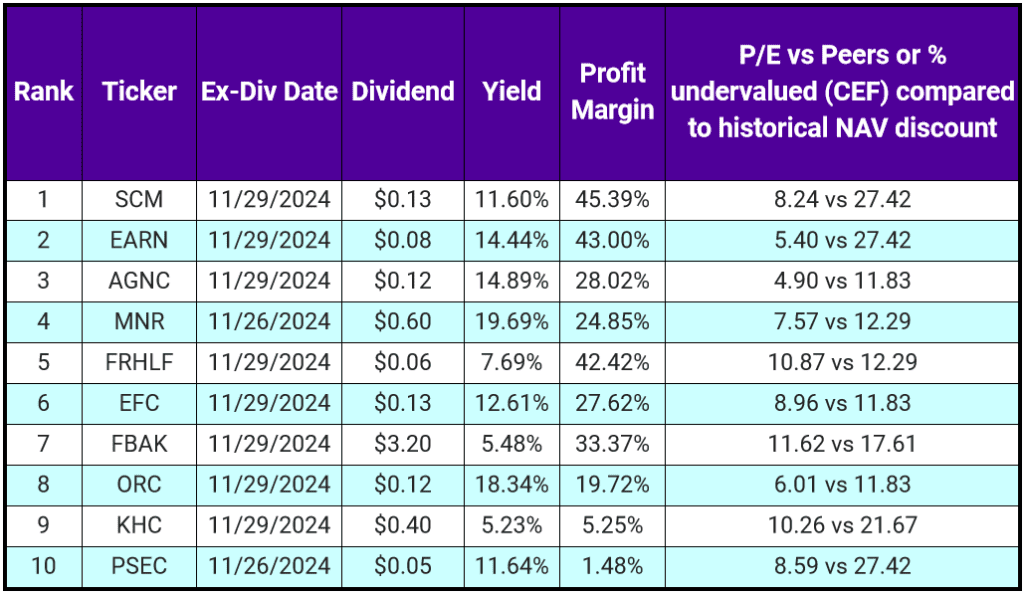

So he decided to put together his own lists to share with you. Stocks that make it into his weekly top 10 have to have high yield, a profit margin that shows they can pay their dividend, and be undervalued.

Here’s an example of a chart.

If you’re looking to invest your money, this is a great place to start looking versus getting overwhelmed by the thousands of stocks available. Tim has already screened and qualified your options and narrowed them down to the best of the best each week.

He also tells you his favorite picks of the group and which ones we’re in or have been in in the past. This is where we find most of our new investment ideas and get in when we have liquid cash available.

Portfolio Updates

We have a few portfolios. Our main one is for our nomadic lifestyle and then we do some growth stock investments in our Roth IRAs. We also manage my mom’s retirement account.

Because we’re always trying to maximize our earning protentional on our small portfolio, Tim gets out of high valued stocks and rolls that money into undervalued investments.

I talked him into documenting what trades he makes each week. One, because it helps us look back and understand what we did and why. And two, so you can see what we’re doing.

There’s so much fluctuation in the stock realm and this way you can see when we get in and out of stocks, and how we implement the strategy we’re always talking about. Our moves may help you make your own portfolio decisions.