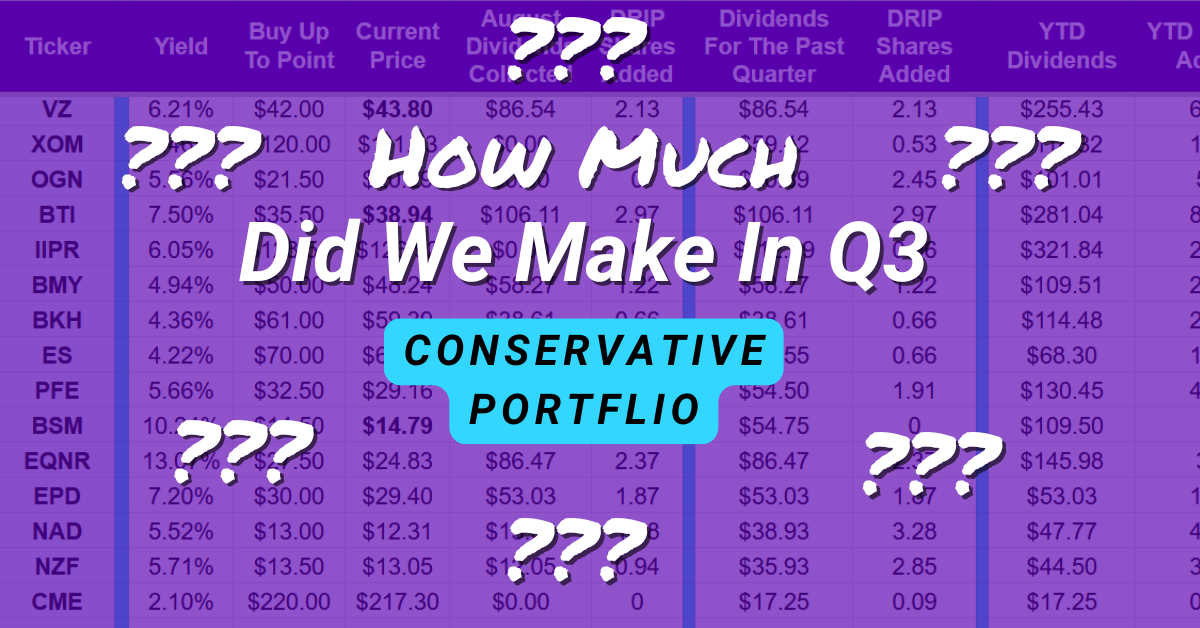

Every quarter we create a breakdown the dividends and how many shares we accumulated for each stock we own. This helps us evaluate our portfolios and gives you a chance to see the results of what we teach.

Since we have a lot of data to process at the end of the year we offset our quarterly updates by a month. So our Q3 is for June, July, and August.

Let’s dig into the dividend data for our Conservative Portfolio. Keep in mind that the current total value of this portfolio is only about $168,000.

If you want informative tidbits as we go through the portfolio payouts, listen to Episode 69 of our podcast.

If this chart is too hard to read on your device, click here to access it directly.

Dividend Breakdown

We collected the following in dividends over different timeframes.

- $1,771 in dividends for the month of August

- $4,252 in dividends for the course of the past quarter (averages out to $1,417 per month)

- $10,293 in dividends thus far in 2024

This portfolio is much more stable and conservative and I fully expect to only receive $1,300 to $1,400 per month going forward the next 12 months. Right now we’re averaging $1,287 per month.

Our average yield in this portfolio is 9.6%, this excludes YieldMax ETFs.

Our Best Performers

Our top 3 best dividend payers are as follows:

MMM – We collected $155 in dividends so far in 2024, and the stock is up 52% for the year.

OGN – We collected $101 in dividends so far in 2024, and the stock is up 60% for the year

NVDY – We collected $920 in dividends so far in 2024, and the stock is up 80% for the year.

Our Worst Performers

Our 3 worst dividend payers are as follows:

IEP – We collected $827 in dividends so far in 2024, but the stock is down 12% for the year.

EQNR – We collected $146 in dividends thus far in 2024, but the stock is down 8% for the year.

ABR – We collected $403 in dividends thus far in 2024, but the stock is down 6% for the year.

We left the DRIP on and collected mad shares of ABR (30) and IEP (50) due to dividend reinvestment. EQNR is a recent addition to the portfolio in 05/2024, we we didn’t accumulate much there.

Valuation Check-In

Only 6 of our 35 dividend positions in the retirement portfolio are overvalued. That means we have a high potential for mad capital gains to go along with huge yields here as well.

Our goal is to show you, that yes you can “retire” and do what you love and want to do on MUCH MUCH less than what you think.

Using Government stats, the average American spends $5,557 a month (excluding housing). Using these absurd numbers without adjusting anything, $425,000 invested like our higher yielding Van Life Portfolio would earn you $5,957 a month in divies.

Fuck that whole “needing over a million dollars to retire” nonsense. Seriously, that tired bullshit-mind-trick to make people work and work and work to feed the machine just needs to die. Sorry!

How Much Is Your Portfolio Generating In Dividends?

Let us know in the comments!