To get the most of out of our podcast we recommend focusing on your foundations first so you have a higher chance of securing your finances. We’ve broken the episodes down into categories.

If you’re interested in investing soon, you’ll also want to listen to recent episodes while you work your way through other topics. Investing is a time-sensitive topic and newer episodes will provide regular updates on stocks, trends, and our strategies.

Eventually you should listen to each episode because you never know which one will spark a big ah-ha moment that changes everything for you. Also repetition of concepts is how you learn.

Note:

If you like visuals, we have videos to go with our podcasts to post on YouTube Channel. Unfortunately, we didn’t start this until around episode 80, but we’re committed to doing it going forward.

**DISCLAIMER**

Ticker metrics change as markets and companies change, so always do your own research.

The content on this site is based on personal experience and is for educational purposes, not financial advice. See full disclaimer here.

Are You In The Right Place?

If you’re new to all things finance and/or investing, first and foremost, we want to make sure that you resonate with our approach for becoming financially independent. We only want you here if it’s the right fit.

We focus on passive income. The strategy is to invest intentionally and take on calculated asymmetrical risk. When you play an active role in our finances and investments you can get to your goals much faster than you can with other methods.

If you aren’t willing to put in the work and challenge yourself a little, we wish you the best of luck in finding what you’re looking for. For the rest of you who are hungry for a more fulfilling life, we’ll show you everything you need to know to get results and avoid mistakes.

The beginning takes more time because you’re learning and growing, but once you get over the hump, it’s pretty low maintenance.

Special Note For Day Traders

I was victim to the allure of day trading, not just once or twice, but 3 times. It’s addictive when you make money out of thing air with the click of a button, but when your method stops working or you make a stupid mistake, it’s not fun.

The first time we lost $25k. The second time over $40k went up in smoke. And the last, I spent $7,500 on a course to teach me a tried-and-true method. I lost a few thousand more during the the first month. Then it dawned on me that it was going to take years to get really good at the patterns and predicting investor sentiment and patience that I didn’t have space for.

I also realized that I’d have to be glued to a screen to keep generating money. The whole reason I started day trading was because I wanted the freedom to follow my passions and really live my life. Day trading is just another form of trading your time for money.

If you want an alternative that generates a lot of passive cash fast, listen to our episodes on YieldMax ETFs. They work so good that we’re currently running an experiment using OPM (other people’s money) to increase our income and portfolio size.

>> Episode 26 – Use Ultra High Yield ETFs To Seed Your Portfolio <<

>> Episode 56 – Which YieldMax ETFs Are Worth It And How To Reduce The Risk To Zero <<

>> Episode 70 – 1 Year Of Our YieldMax ETF Performance <<

What’s Your Retirement Number?

Pretty much every other investing strategy tells you to try to guess what you think you need in retirement years down the road. Most likely your needs will be different and our dollars will buy less. I don’t know about you, but that sounds flawed.

The magical target for most people is a cold hard $1 million (just to make $3,000 a month) because financial experts tell you to use the 4% rule. The idea is that you liquidate 4% of your investing portfolio each year until you run out. This is dumb math because…

This approach leaves you at the mercy of the value of the stock market, which can make you run of out of money well before you hoped, especially if you live longer than expected. It also gives you inconsistent amounts of money. We guarantee that you’ll feel anxious and stressed if you subscribe to those methods.

>> Episode 40 – Eliminate The Worry Of Outliving Your Retirement Funds <<

We focus on how much money you currently need a month to secure your finances. The goal is to create passive income and grow it until you reach your target. There are many ways to do this, but income investing is our favorite method because it’s low effort and high reward.

>> Episode 4 – How To Cut Your Retirement Goal In Half <<

So now let’s calculate what the estimated amount of capital you’d need to invest right now to hit the same $3,000 monthly target from above.

Take your monthly income and multiple it by 1200. Then divide by your expected yield rate. We’re going to be conservative here because it’s better to happily need less than sadly need more.

If you’re completely averse to risk you’ll use 10% to 12% as your yield; high risk individuals can put in 18% or 20%, and if you’re somewhere in the middle, go with 15%.

$3,000 x 1200 / 15 = $240,000

$240,000 is much much less than $1 million. Let that sink in.

Many of you might have that right now in a retirement account that you can’t touch until you hit age 59 1/2. Trust me, I know the pain. Others might have this money if they sold their unused stuff or took the equity out of your house.

If you’re questioning if this is really possible, we want you to look at our investments. Each quarter we post our dividend earnings for the 2 portfolios we manage. One is focused on high yield, the other is more conservative and focused on capital preservation.

How To Make More From The Stock Market

While everyone is chasing growth stocks in the hopes of finding the next Amazon, we focus on stocks that pay income in the form of dividends.

>> Episode 2 – Why Income Investing Is Better Than Chasing Growth Stocks <<

Growth stocks need to be sold to get your money, which means you no longer have an asset. Fear and greed turn stock prices on a dime. You can try to time it, but the one area that we still struggle with is when to sell growth stocks.

With dividend stocks, you don’t have to ever sell to keep making money. And if they fall in price, you can buy more shares at a discount. This increases your dividends dramatically because they’re based on the number of shares you own. The value of the stock you hold, doesn’t’ really matter.

We did it wrong too for years before we stumbled onto income investing.

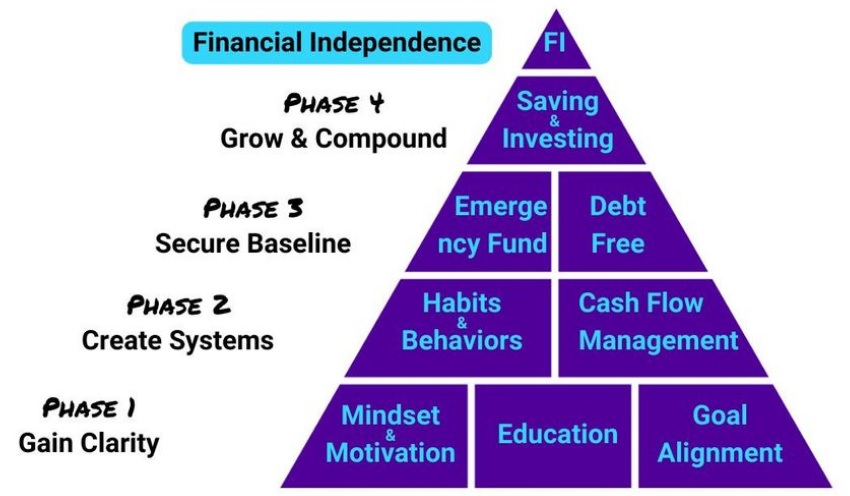

Building A Strong Financial Foundation

I know you might be excited to jump into income investing ASAP, and you can if you have the money sitting around. But, you should also work on your financial foundations. This will help you find more money to invest, which speeds up the time it’ll take you to reach financial security and freedom.

If you don’t have the money or have debt, you desperately need to work on the foundation pieces. This will change your life. The key to success in finance is the things that no one wants to focus on. But if you want to be in a different and happier place, you need to commit to these areas.

Education

This is an ongoing area all throughout life. It’s hard in the beginning, but the more you expose yourself to new information and take action, the easier it becomes. Take things little by little and you’ll become a master in no time.

I will say there are going to be things you need to unlearn because we’ve been taught many things about money that are wrong or just not in alignment with becoming financially independent. Realizing what you don’t know is a powerful first step.

>> Episode 72 – What’s Your Financial Intelligence Score <<

I still read tons of finance and investing books. Much of the information doesn’t apply to our desired goals, so we’re going to focus on the stuff that does and integrate concepts from areas outside of finance to enhance our results. Action is another important piece.

If you find yourself struggling here, check your mindset. Do you have a growth mindset or a fixed mindset? This one aspect can make everything going forward harder and unpleasant or actually enjoyable.

Do yourself a favor and read Carol Dweck’s book about mindset. If you don’t have an Audible account yet, you can get the book (plus 1 more) for free when you sign up. Using this link gives us a small commission. If you buy through it, thanks for the support.

Your Mindset, Beliefs, Habits, And Behaviors

If you feel resistance here, that means you have work to do. This area is one of the hardest parts of financial success, and skipping over it will handicap you.

Your beliefs and mindset shape your habits and behaviors. The subsequent actions give you results (or the lack there of). If you want a different result, you have to do things different. It’s really that simple.

You can force it and try to rely on willpower alone, or you can fix things at the root so that discipline becomes easy. The choice is yours. To get started, you have to become aware of what’s going on and that might be uncomfortable.

Lean into it. Freedom is on the other side.

>> Episode 61 – Why Saying “I Can’t” Derails Your Financial Success <<

>> Episode 60 – The 5 Misconceptions Of What It Means To Be Frugal <<

>> Episode 77 – What Are Money Scripts And Why They’re Ruining Your Life <<

>> Episode 73 – How Instant Gratification Drains Your Wallet <<

>> Episode 17 – Exposing Behaviors That Hijack Your Ability To Invest <<

>> Episode 43 – How Tech Resistance Will Limit Your Future Wealth <<

Goal Setting

Setting goals is an essential step for achieving anything. If you don’t know where you’re going, you’ll waste a lot of time, energy, and money going somewhere else.

Your goals will directly affect the strategy you develop. This is how you plan and take action steps to get where you want to go, and how fast. But the key here is choosing the right goals. Everyone is different.

If you don’t know what you really want, you’ll take on someone else’s goals and wake up one day wondering WTF went wrong. I’ve been there and trust me, you want to get busy fixing your situation instead of putting it off until it’s too late.

>> Episode 87 – Fail-Proof Process To Knock Your Goals Out Of The Park <<

>> Episode 48 – Why You Shouldn’t Wait Until Retirement To Start Living <<

Knowing yourself is vital as it helps you align with the things that are important to you. It clues you in to your risk tolerance and helps you stay motivated to reach your goals because your “why” is so compelling that it’s worth the challenges.

>> Episode 32 – How Being Unaware Of Your Investor Profile Leads To Losses <<

It’s not wise to put off the things you really want. Your subconscious knows what you need and if you deprive yourself of those things, you’ll compensate elsewhere. This ends up costing you more money, your health, your relationships, and your happiness.

>> Episode 35 – Why You Should Do More Of What Your Really Love <<

>> Episode 73 – The “I Deserve It” Mentality Makes You Broke <<

Cash Flow Management

You determine where your money goes and what it does. If you’re submissive to money, you’ll always have issues with it. This is the underlying premise of a budget, but the word budget triggers people. So let’s call it intentional spending, which I like better anyway.

>> Episode 10 – Why You Need To Know What You’re Spending Your Money On <<

You should definitely track your expenses for at least 3 months to figure out where you stand. Then you can overhaul your spending categories. You cut back on things that aren’t important and increase in areas that are. And it’s not always about cutting things out, but finding cheaper alternatives.

From here you set up systems to make things easy and automatic. Then check in every monthly and tweak things until you like your system, and it’s working for you.

The big key here for having extra money to save or invest is to do it first and make it automatic. I don’t care what you have to do to do that, get it done. This is your freedom fund; prioritize it like your life depends on it.

Where To Put Your Freedom Fund

There are several different accounts that you need to funnel money into: an emergency fund, saving for short term goals, and investing.

You need to have a bare minimum emergency fund in place before you start investing to prevent you from having to liquidate your stocks. This is your biggest stock market risk. You will lose money if you skip this.

Start with $1,000 and then you can start investing while you increase it to 3-6 months worth of living expenses as you go. Put this money aside someplace that’s liquid and earns you money.

Where you put this money depends on how fast you need access to the cash. If you need it within a couple says, you should go with a high yield savings account (HYSA). Capital One 360 and Discover 360 would be our picks as they tend to have high competitive rates.

>> Episode 6 – A Worthy Place For Your Emergency Fund That Earns High Interest <<

If you’re a responsible credit card owner, that doesn’t carry a debt balance, I’d put emergencies on a card and then move your savings funds to pay off the balance. This allows you to earn higher interest rates with places like Worthy Bonds. Right now they’re paying 7% and you’re making interest daily.

The last place is in the stock market via a brokerage account. This money should never come out of your dividend stocks portfolio until you reach your financial freedom goal.

>> Episode 44 – Which Brokerage Company Should You Invest With <<

Ways To Find More Money

If your budget is tight, you’re going to need to find alternatives to fund your investing account. First try to get a raise at the job you already work. Keep track of ways you go over and above at work and use that to ask for a pay raise.

You can also take on one or several side hustles. Some people rent space out or flip things. Other ways involve saving money on things you have to do. Swap out your phone carrier, do free activities vs paid, and shop at a bargain grocer. There are tons of small things that will add up when you stack them.

>> Episode 49 – 2 Sources Of Money That Can Seed Your Portfolio Without Cutting Your Spending <<

>> Episode 50 – Reconsider Your Living Situation Save Money Renting Versus Buying <<

>> Episode 51 – Save Hundreds A Month Without Giving Up The Things You Love <<

Then you have creative ways to make money. This often involves taking advantage of opportunities you wouldn’t normally think of like signing up for new bank accounts that pay you sign-on bonuses. Credit card companies do the same thing.

And our favorite way, but highest risk, is to leverage incredible stock funds that pay you based on the profit they make from trading options. Some of these pay 100%. To put that in perspective, 10% is considered to be a high risky yield by most experts.

>> Episode 26 – Use Ultra High Yield ETFs To Seed Your Portfolio <<

The strategy here is to take the profit from these and funnel it into safer stocks. These aren’t long-term holds, but if they’re used right you can supercharge your earnings cutting your time to financial freedom down exponentially. Plus you don’t have to hustle to earn money.

But you do have to follow our strategy to reduce your risk. Once you understand what these YieldMax ETFs are, listen to other episodes that show you how much we’re making in them, which ones are good, and how we keep evolving our strategy so you can profit.

Learn To Invest For Income

If you skipped to this section, make sure you don’t start investing until you have an emergency fund set up. Go do this now. You’re increasing your risk of failure if you proceed without having one.

The highest risk in investing is having to sell stocks because you need money while the market is down. If you have savings outside the market for emergencies, you don’t have this risk. Period.

Investing Mindset And Emotional Control

The best time to get into the market is when it’s down. This is when you make the most profit and it’s even more lucrative for dividend stocks because your payouts are based on the number of shares you own. You can get more shares the lower you buy.

>> Episode 3 – 5 Reasons That Down Markets Are A Good Thing <<

Emotional control is a huge part of successful investing. This is much harder for growth investing than it is for dividend investing because the value of stocks don’t matter as much. And you actually see the fruits of your labor verses needing to sell to get any money out.

Aside from focusing on dividends and not the value, you need to be calm. There is no room for emotions in investing. Practice stoic principles and work on your health. You’ll be surprised how much that does for your emotional regulation.

>> Episode 34 – Use Stoic Principles To Become A Less Emotionally Reactive Investor <<

>> Episode 20 – Why You Can’t Ignore The Link Between Health And Investing <<

The other thing that contributes to emotional issues is not investing for your risk tolerance. You need to work with the kind of investor that you actually are. If you’re someone who has a high risk tolerance, you’ll actually lose money if you try to invest conservatively and vice versa.

>> Episode 32 – Invest In Alignment With Your Investor Profile <<

Even the most risky strategy can be successful if you know how to reduce unnecessary risks. Believe it or not, but the highest risk of investing is YOU. Short term fears and FOMO reactions are what sabotage our results.

The best thing you can do is become aware of your behaviors and create a plan to strategically minimize your risks. Don’t let overwhelm paralyze you into inaction. You have to be in the game to win. Just take small steps over time, and remember, the market always goes up in the long run.

>> Episode 22 – Awareness Of Cognitive Biases Makes You A Better Investor <<

>> Episode 37 – Don’t Let Analysis Paralysis Keep You Stuck <<

>> Episode 38 – How To Navigate The Different Types Of Investing Risks <<

Open A Brokerage Account

Now that you’re prepped, you can start building a portfolio in a brokerage account. You’ll need to figure out which type of account is right for you based on your situation, age, and goals. Then you open an account with a brokerage company, or through your job if you go with that option.

>> Episode 46 – Do You Want A Retirement Account Or A Regular Brokerage Account <<

>> Episode 44 – Which Brokerage Company Should You Invest With <<

What Stocks To Invest In

Employer 401(k) plans have limited options, but when you have a self-managed brokerage account, you get access to thousands of stocks and markets. To prevent overwhelm, you need a strategy to narrow down potential investment candidates.

Because stock prices change daily, it’s hard to recommend anything specific. The best way to know what we’re doing is to keep up with the most current podcast episodes and get on our email list. Tim sends out his top 10 stock picks each week that are already screened as well as our portfolio updates.

But since our ultimate goal is to teach you to do it all yourself, we want you to learn to screen stocks, interpret their metrics, and know when they’re at the right price. Buying undervalued stocks creates a margin of safety against value losses to keep your emotions at bay and earns you higher profits.

>> Episode 39 – Use Our Investment Screener To Find Investment Opportunities <<

>> Episode 19 – How To Determine If A Stock Is Undervalued <<

>> Episode 58 – How We Decide If A Stock Is Worth Investing In <<

>> Episode 59 – How To Evaluate Close-Ended Funds <<

Ways To Improve

Once you have the basics under your belt, there are ways to improve your investing skills and increase your chances for success. A big hurdle is getting your mindset and emotions in check as we discussed above. The rest comes with experience and practice.

You’ll need to monitor the stocks in your portfolio and make adjustments as metrics fluctuate. Company data changes over time, so you need to be aware of what’s happening in case it affects you.

>> Episode 18 – How Often To Look At Your Portfolio And When To Make Adjustments <<

The next big thing is learning to anticipate market moves before they become trends. This is where contrarian investing comes in.

Depressed sectors don’t stay down forever. The most money is made when you get in before the experts and media start talking about these opportunities. When everyone is optimistic these stocks become overpriced.

I don’t know if Tim has oracle powers or what, so definitely keep listening to the podcast since he drops nuggets and tickers all the time. You can definitely learn to pick which sectors will do well and get into funds versus individual stocks to increase your chances to profit.

>> Episode 21 – Learn To Anticipate Macro Trends To Get Ahead Of The Crowd <<

>> Episode 43 – How Tech Resistance Will Limit Your Future Wealth <<

Total market index funds are a smart option, if you want to wait 30 years to retire and not make any dividends while holding them. That’s not us, so we look for new types of investments to increase our income and minimize our efforts. When we see opportunities we experiment and relay the info to you.

One of our favorites is a collection of funds that pay out huge dividends by trading options on different top growth stocks — none of which pay a dividend themselves.

If you use these YieldMax ETFs right, you can increase your monthly earnings or leverage their income to grow your portfolio faster. More and more of these types of investments are coming out. FEPI and AIPI are two others that don’t pay as high (still ~35%), but they are less risky.

>> Episode 26 – Use Ultra High Yield ETFs To Seed Your Portfolio <<

What’s Your Starting Point?

We’d love to know where you’re at on your financial freedom journey. If you have any questions or want help figuring out where to start for your specific situation drop us a comment below. (No email required)