To understand our top 10 lists that we provide, read on. To jump straight to this week’s list –> click here

There are tons of top stock lists out there, but I’ve found that most don’t provide me much value since they don’t line up with my investing strategy.

You see lists that just focus on high yields, which we all know can be risky if you aren’t qualifying those companies in other ways.

And the “best” dividend lists only seem to focus on well-known Dividend Aristocrats. Yes, it’s great when companies consistently raise their dividends, but the issue with these is they’re often overvalued and therefore have low current yields.

Popularity and low yield tend to go hand in hand

Not only do I want high yields, but I also want to hedge my risk by buying companies that are undervalued and have profit margins that can sustain their dividends.

So in order to find what I want, I have do my own digging. The stocks I find are often overlooked or unknown. And that’s usually where the sweet juicy profits lie.

I do all this weekly for myself to find new investments and keep on top of the ones that are already in our portfolios. I hope my weekly summaries help narrow the field and save you a lot of time with your own research.

How To Use The Weekly Charts

Each week’s top 10 list is only for stocks that have an ex-dividend date in the range. The ex-dividend date is important as it’s the date you need to own a stock in order to qualify for the up and coming dividend payout.

I rank my finds based on several factors. Their profit margin is one of the most important things along with whether an investment is undervalued compared to their peers or historical NAV price for CEFs.

My comments below each week’s chart contain important tidbits and considerations. Make sure you read them.

You don’t always want to buy a stock before its ex-div date

If a stock is a monthly payer, I usually wait until after the ex-div date to buy shares since dividend stocks drop the equivalent of the dividend in stock price on that date. That means you get a discount and possibly get to buy more shares with the same dough.

For quarterly-paying stocks (or less frequent), you’re going to want to get in before the ex-div date to make sure you secure the up-and-coming dividend payout. Otherwise you have to wait a long time to get paid, and that’s no fun.

And now, here are my top 10 lists. Each chart is posted before the upcoming week.

You can jump back to past charts to look for patterns or repeat tickers. I definitely do. You can even go back further to last year.

December | November | October | September | August | July | June | May | April | March | February | January

April Weekly Ex-Dividend Picks

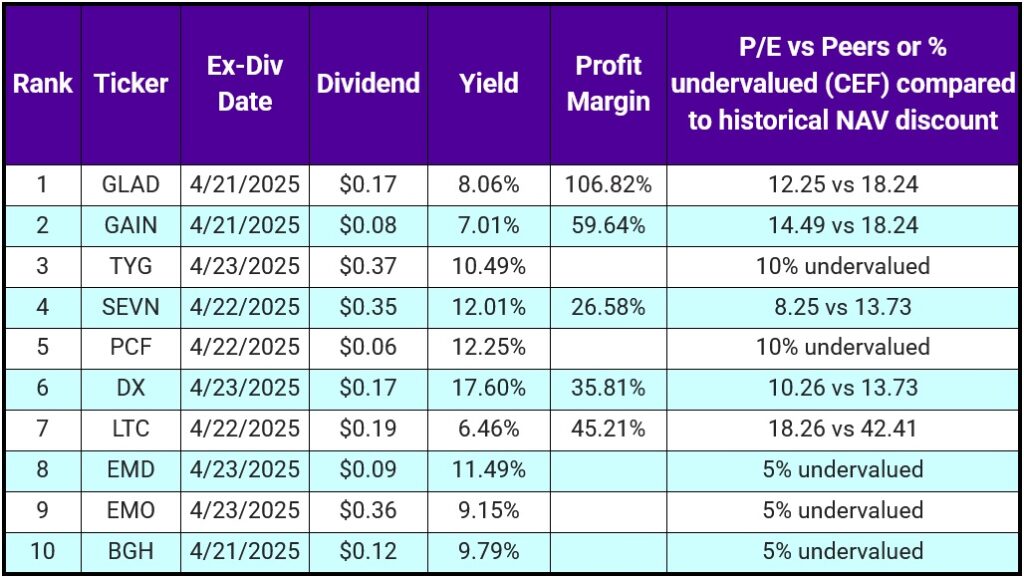

April 21st to 25th

Another week of CEFs having a strong showing in this space. As I’ve said before, I love CEFs because you get a basket of stocks and a nice yield to boot. And if you haven’t checked out Contrarian Outlook, you should. Brett Owens is like the CEF King.

We hold none of the investments in this week’s chart, but we have held DX, GLAD, GAIN and LTC previously. Why none now? Stock value and money availability don’t always line up. But if I had extra money to invest in this list, I’d start with TYG and then pick up the BDCs and REITs.

TYG holds all the best American oil plays like ET, MPLX, EPD etc. Plus you’re getting over 10% yield. Nice time to stock up on a sector that’s been depressed due to OPEC nonsense. Oil is not going anywhere, anytime soon. Embrace the fact and make money from it.

Want These Weekly Charts Sent Right To Your Inbox?

We update this page each week, but if you’re worried about missing this time sensitive information, get on our free Investing IINsights email list. You’ll also get market updates and see what we’re doing in our portfolios.

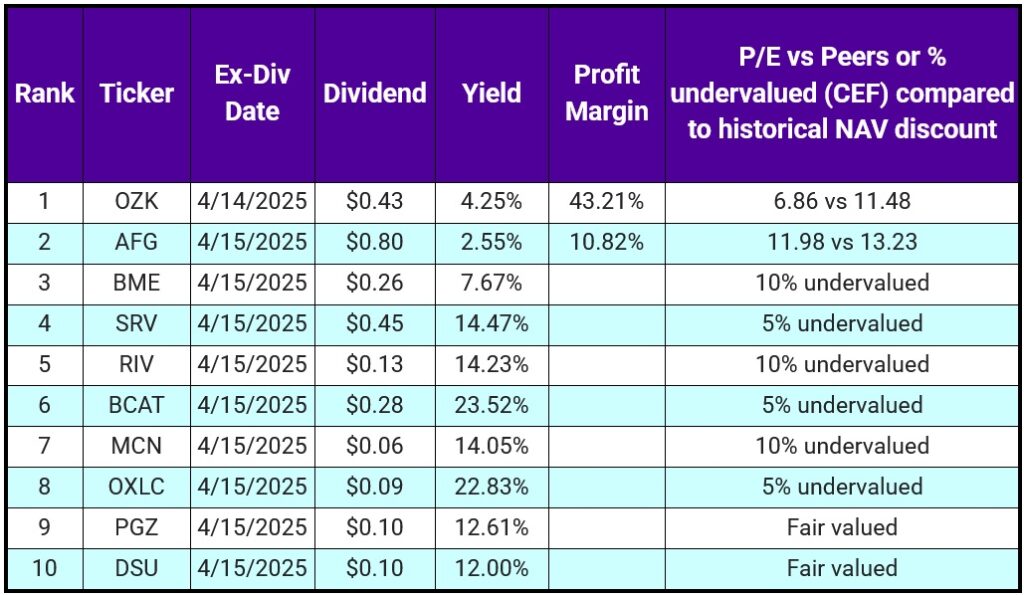

April 14th to 18th

CEFs (Closed Ended Funds) are back in a HUGE way with 8 showing up in this week’s list. I suspect they’ll be popping up on these lists for the next couple of months. This video walks you through how we evaluate CEFs.

Quick refresher:

- look for the discount to NAV percentage.

- buy when they’re at a discount to NAV

There is a difference between the current discount to NAV and the historical discount to NAV ratio. Most brokerages or CEF lists will provide the current discount to NAV, but that’s not the whole picture with these investments. If something is 10% less than the NAV (Net Asset Value for the investments is holds) that can be nice, but if it has historically traded at say 20% discount to NAV, then it is 100% overvalued compared to historical data.

Schwab makes this easy. Vanguard, Wells Fargo and Sofi do not have these screener capabilities. If you can’t find this in your brokerage, you may want to open a Schwab account just for research purposes.

This Week’s List

You should definitely have this week’s CEFs on your watchlist. I expect heavy volatility, so you can probably get any of the CEFs at a lower price. 6 of the 8 CEFs are discounted compared to historical data, and 2 (PGZ and DSU) are trading fair valued as of yesterday.

I like all 8 CEFs because they’re either deeply discounted compared to historical data or provide enough yield to cover any losses until we reach the bottom of the market pull back. By this I mean if you bought either PGZ or DSU today, the 12% yield should cover any losses you may incur as I don’t see these investments falling another 12% over the coming months. Got it?

We currently hold OZK, AFG, BME and SRV from this list. We have held OXLC, RIV and DSU previously.

April 7th to 11th

Due to the chaos that happened yesterday, there was way too much to go through to get a reliable and awesome top ten this week. Next week we’ll be back to normal (hopefully). The list I had researched out completely changed, and I would literally have to go back to the drawing board to get accurate numbers. Too little time for that to get you this email today. Sorry, but that’s life. Roll with the punches.

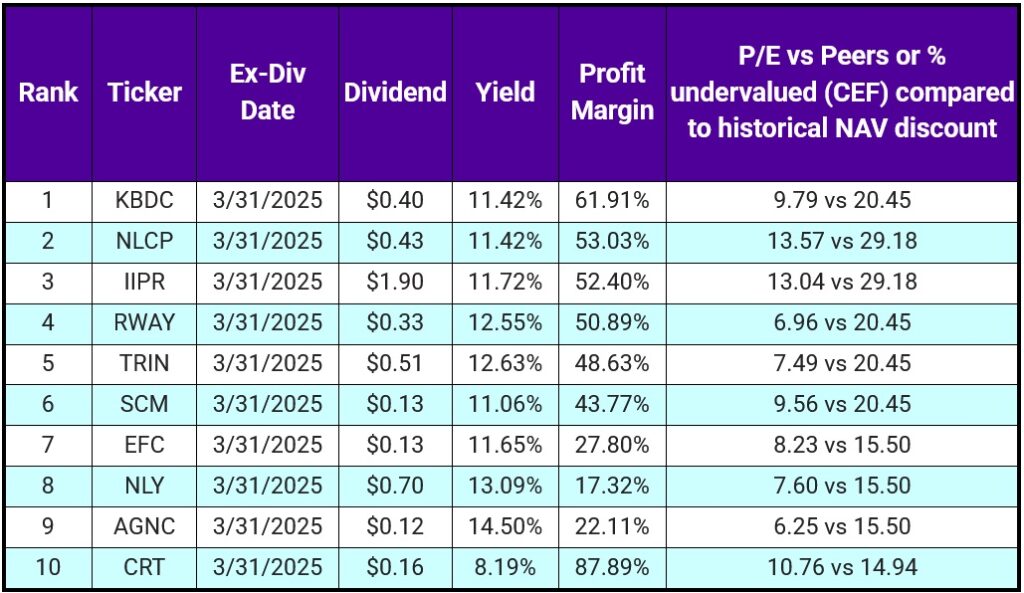

March 31st to April 4th

Whoa Nelly! !hat a list we have this week! You’re getting some mad yield, with high margins, and on the cheap. Yeppers, any of these 10 will make you bread.

CRT is a variable divie, otherwise it would be higher on the list with that banger profit margin number.

We hold IIPR, RWAY, TRIN, SCM, and AGNC currently. We did previously hold CRT, but I didn’t like the huge swings in dividend payments. That’s me; you could be different.

March Weekly Ex-Dividend Picks

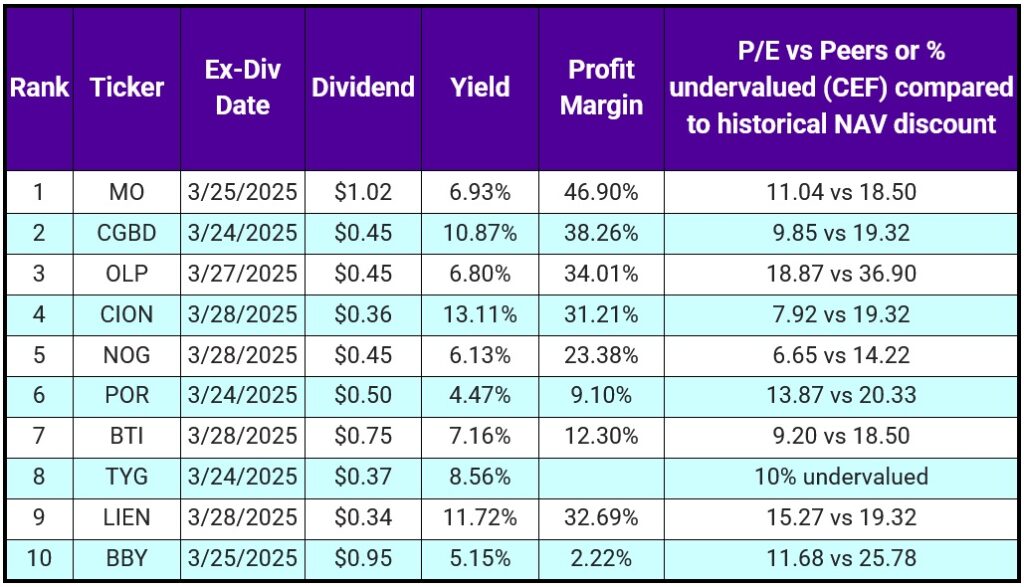

March 24th to 28th

This is a good week to pick up undervalued stocks to dump your cash from YieldMax and REX shares into. Nothing wows us this week for yields, but any of these stocks could be awesome to add to each week (or month, depending on your dividend setup) using your “riskier” ETFs.

We hold MO and BTI and both have been amazing since we got into them. OLP, NOG, BBY and POR would be excellent to get into and start growing.

I really didn’t intend for this week’s list to have so many dividend growth stocks, but that’s how the valuation metrics came out.

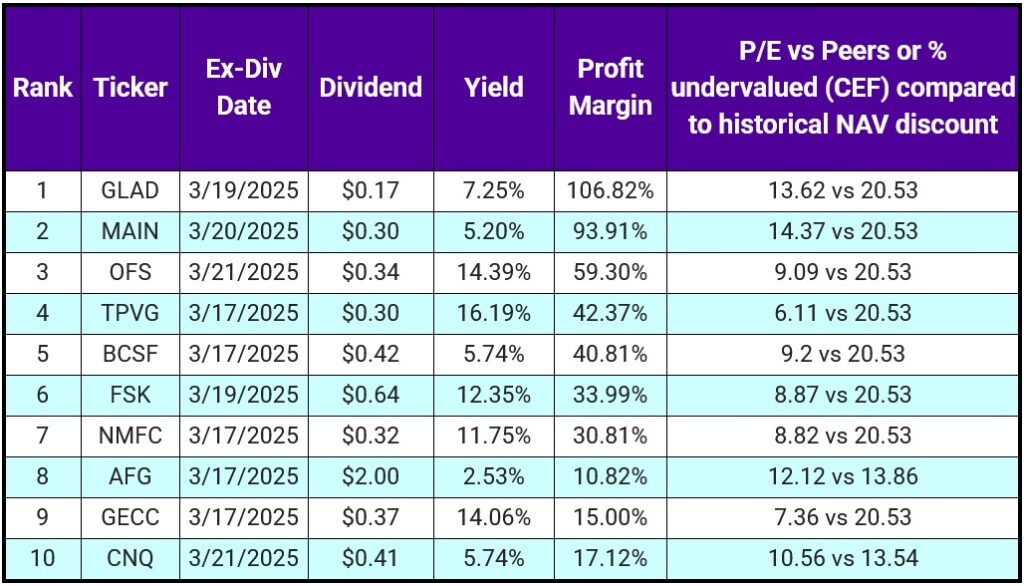

March 17th to 21st

A lot of BDCs on the list this week, but I can’t control what goes ex-dividend now can I? I like all 10 of these based on valuation and their charts.

MAIN and AFG are both dropping a special divie this week, normally MAIN pays $0.25 monthly and AFG pays $0.80 quarterly. So getting in on a week where a special is paid means more money (and more shares) when the regular dividend drops.

CNQ is a Canadian company so you have to account for the tariffs and for the currency conversion when investing in it.

We hold FSK and AFG, but have held GLAD and MAIN previously. GLAD and MAIN are a little bit too pricey for my liking, considering you can get OFS or TPVG (which yield more and have good margins) for like 10%-20% cheaper. But that is me.

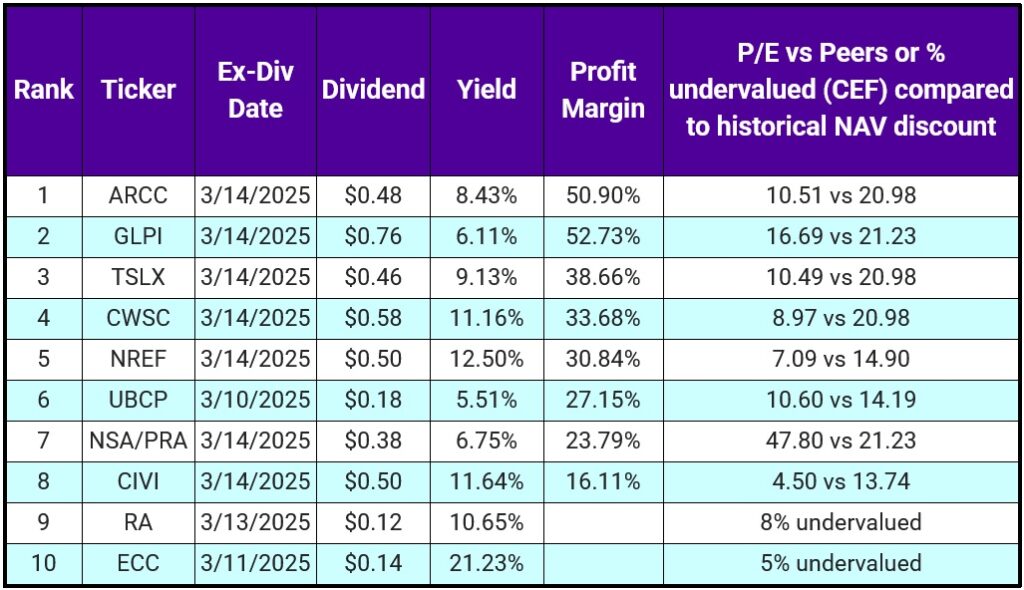

March 10th to 14th

BANGER list this week. All 10 should make you bread. I would invest in them in the order they’re listed, but that’s me.

NSA is a very overvalued stock, but its preferred is 12% undervalued and yields almost 2% more than the common stock. So that’s a no-duh.

We currently hold ARCC and CIVI from this list. In the past, we’ve held CWSC, RA, and ECC. Again all are amazing, so enjoy the divies.

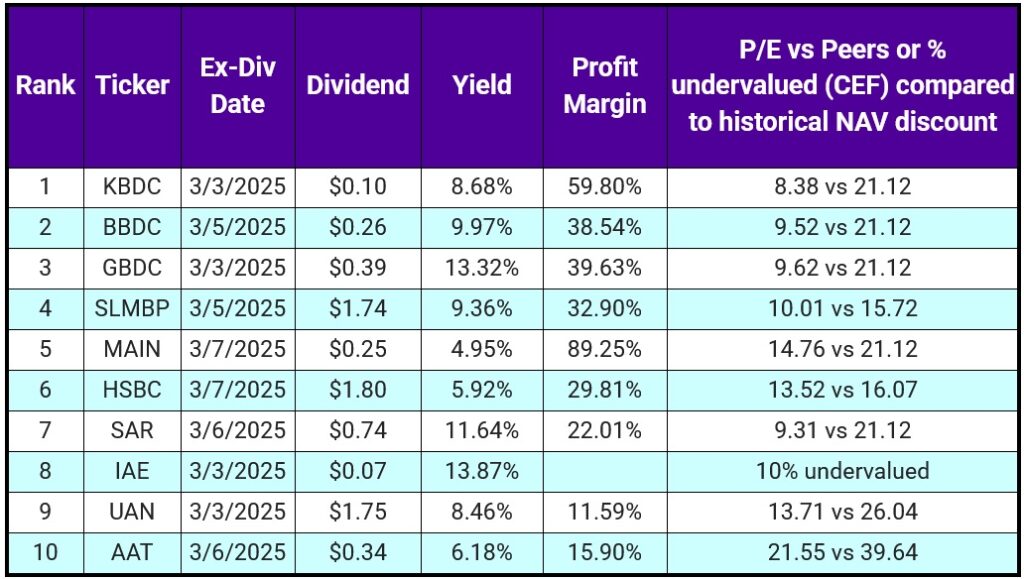

March 3rd to 7th

Lots to see this week, but first some housekeeping.

KBDC has a normal dividend of $0.40, which goes ex-dividend at the end of March. This month’s divie is a supplemental, but it’s a good time to get in, get some extra bread, and then be in position for the next dividend.

SLMBP is a preferred that’s 25% undervalued, but it’s expensive at $75 per share. The issuing company SLM has very good metrics. It only yields 1.7% for the common shares compared to 9.36% for the preferred. SLM is a student loan issuing company, so yeah.

IAE is a CEF that deals in the Asian market area. That area is forecasted to grow a lot in the next 3 to 5 years. IAE is 10% undervalued compared to its historical data.

Finally, MAIN (which we just sold because it was getting super overvalued) still has very good metrics and is issuing a $0.30 supplemental divie to go along with its normal $0.25 monthly divie. If you think it’s good to pick up, now would be an excellent time to earn some extra bread.

We only hold UAN (our fertilizer stock we’ve held for years now) of this list of 10. If I had extra cash I would like to get into SLMBP, HSBC, IAE, and GBDC. But I don’t have cash; hopefully you do. Ha

February Weekly Ex-Dividend Picks

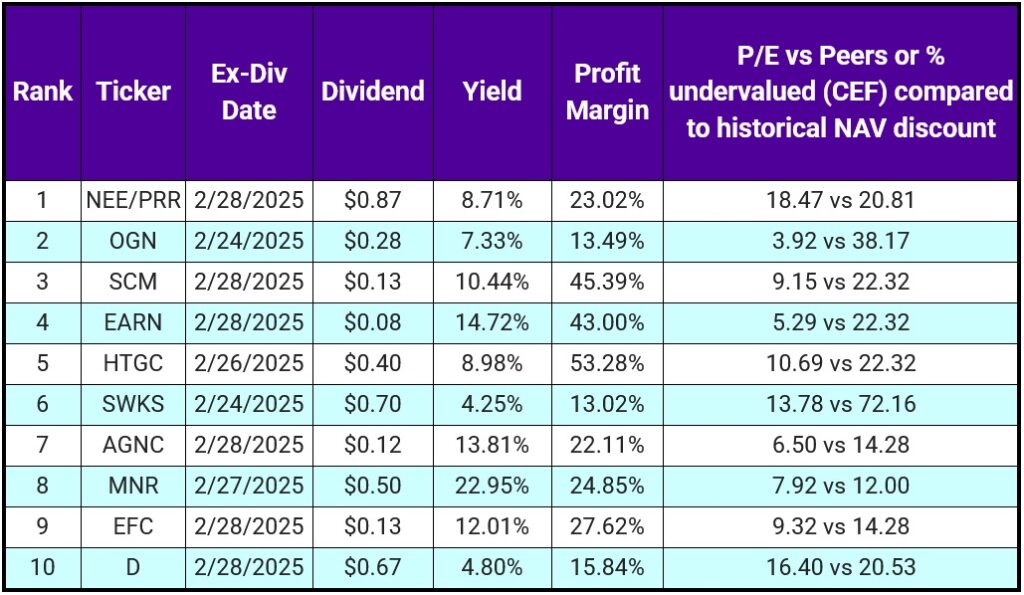

February 24th to 28th

This week’s list is really good for making money. We hold 6 of the 10: OGN, SCM, HTGC, SWKS, AGNC and MNR.

NEE/PRR is 20% undervalued and yields almost 3 times what NEE yields, that’s a no-brainer. EFC is at the high end of the band it’s traded in for over a year, so I would wait for EFC to fall back to around the $12 range before buying.

HTGC pays out a special divie, but keep your eyes on this one. Last year the special was $0.08 a share. This quarter’s special is only $0.07.

This doesn’t seem like a big difference, but the fact that they didn’t pay the $0.08 supplemental divie like they did in 2023 and 2024 means something could be afoot. I’m not saying it will tank. They could just be planning to increase their normal dividend like they did in 2022. Either way, it’s best to follow any news.

MNR is a variable divie, so the 22.95% yield is a little high. I wouldn’t hold this in an account that you need to be consistent.

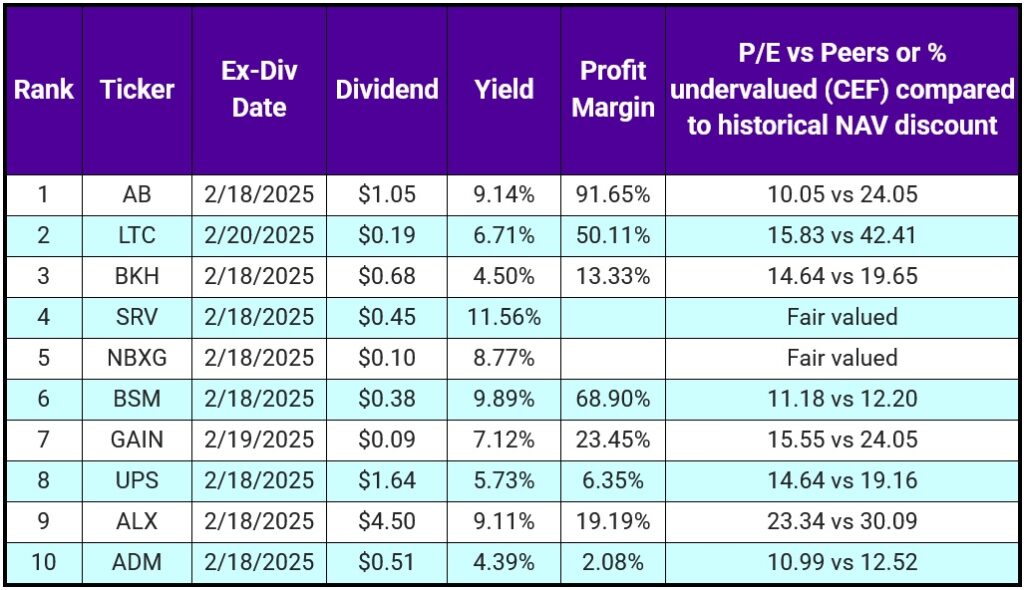

February 17th to 21st

Bangers galore this week. This may be one of the best, if not the best list I’ve ever presented to you all.

Valuations are getting kinda tight, compared to months ago, but that’s to be expected in a bull run. Still, this list presents a lot of value, plus dividend growth from BKH, UPS, ALX and ADM. We’re talking multi-year dividend streaks.

The most intriguing is AB. That divie, plus yield, plus margin, plus valuation is absurd for a $35 dollar stock. Those are like MAIN numbers, but without all the hype and the $60 price tag. You also get 100% more in divie payouts. If you haven’t looked into AB, I urge you to do so.

We hold BKH, SRV, NBXG, BSM, UPS and ADM in our portfolios. UPS is the worst of the 6, believe it or not. 😄 And I just had to have AB after seeing the metrics.

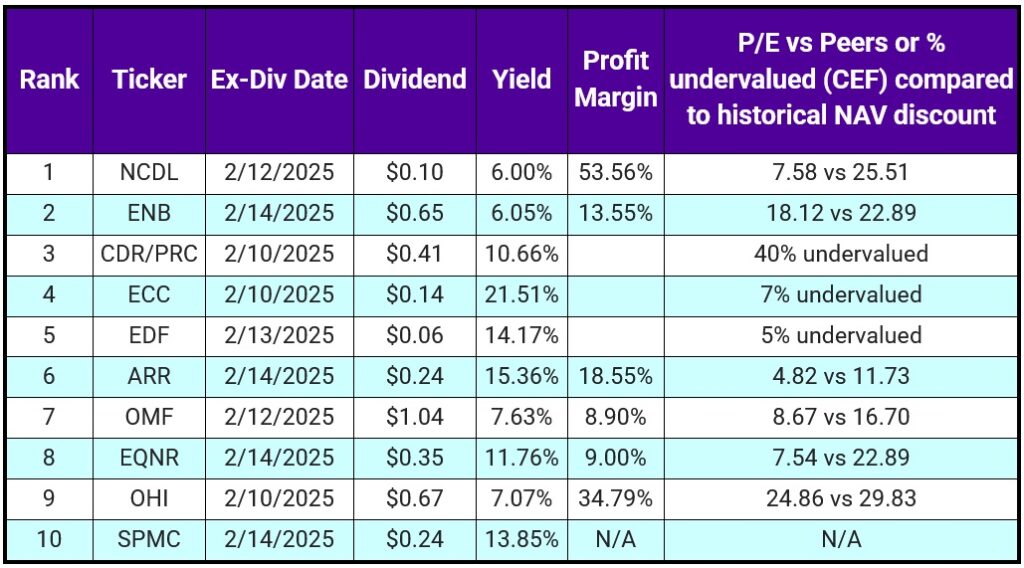

February 10th to 14th

We have a bunch of names you may not be familiar with this week. We’ve held ECC, ARR and EQNR previously, but hold none of these at the current moment.

A Couple Notes

#1 NCDL (a BDC) normally pays a $0.45 divie for a 10.4% yield, but this $0.10 is a special divie. The numbers on NCDL are amazeballs.

#2 EQNR also pays an additional $0.35 in the form of a special divie on the same day, so you could get 100% additional cash for owning this one this quarter.

#3 Finally, I would put SPMC higher on this list, but I can’t find any reliable sources to get the valuations for it. I suspect, like most BDCs currently, that SPMC is well valued and has awesome margins, but I don’t know for sure.

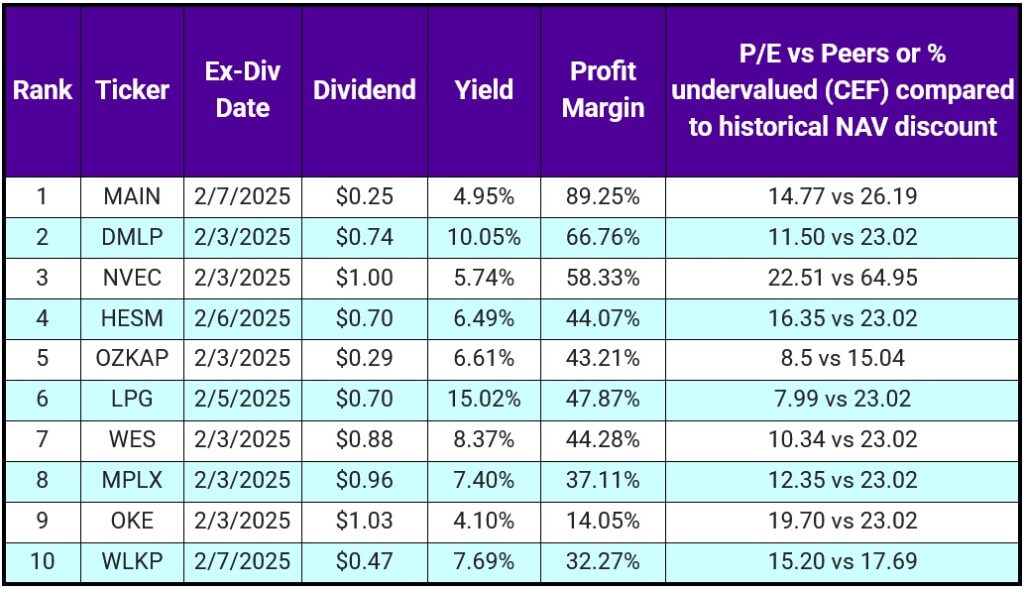

February 3rd to 7th

Yeppers, all good this week, but the top 10 are very heavy in the energy sectors. I really like each and every one of these.

We hold MAIN and OZK (OZKAP is the preferred), but we do have access to HESM, LPG, WES, MPLX and OKE through SRV, which we hold.

This is what I’ve been talking about when I explain CEFs. You can get access to a lot of good stocks if you just dig into what the CEFs holdings are. SRV yields 12% and holds lots of great companies. Why complicate matters and hold a bunch of stocks individually, when you can hold a basket?

January Weekly Ex-Dividend Picks

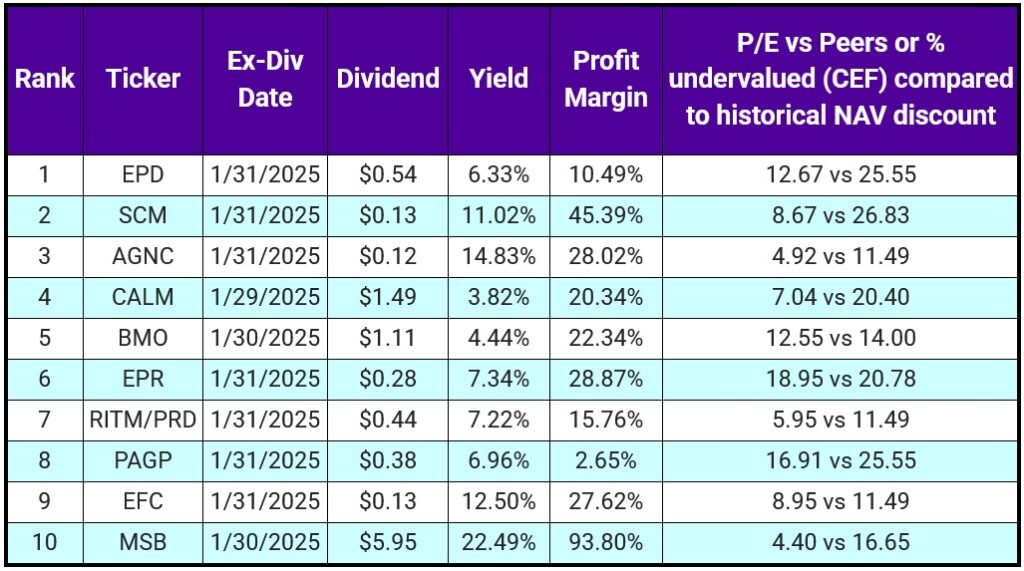

January 27th to 31st

I know, nice list right? 😄 thanks. We have a little of everything this week.

BDC ☑️

Mortgage REIT ☑️

Banks ☑️

Midstream oil ☑️

Mining ☑️

Eggs ☑️

Based on the values, any of these will generate income and price appreciation. We currently hold EPD and AGNC. We’ve held EPR, PAGP, EFC and CALM previously.

The only one to be wary of is MSB. It’s a mining stock that pays out a variable divie, and sometimes no divie at all. But $5.95 for $30 stock with those margins and valuation compared to their peers is a no brainer.

PAGP has weak sauce margins, but it’s predicted to grow its revenue and EPS by 10% YOY the next 5 years. So me thinks the margins will improve. Other than those 2, which I would still buy, have fun making money with this list.

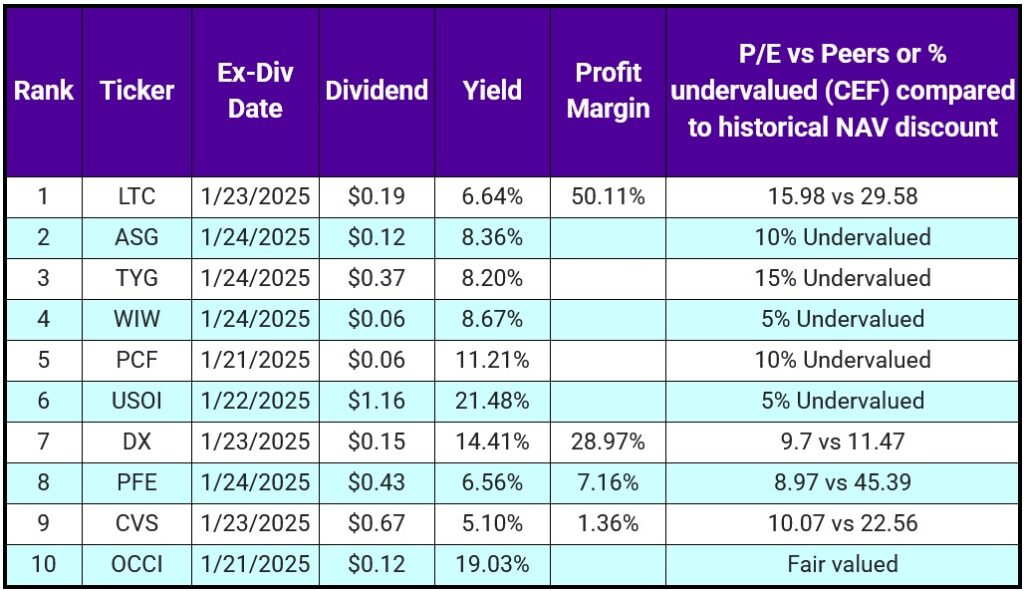

January 20th to 24th

A lot of value this week, Yippie Kai-Yay! I should mention that USOI has a variable divie, which means some months are not as nice as this month.

We hold none of these in our portfolios, but we have held LTC, ASG, WIW, USOI, DX, and PFE previously. In fact we just sold PFE a few weeks ago because I’m not a huge fan of how they’re running things. Plus the incoming administration will make pharma stocks very volatile.

I do believe LTC is the best of the lot, only because we are getting older as a population and they have some very nice margins. The yield is yucky, but you should see some decent to awesome price appreciation.

If it was me, I’d do an equal distribution of ASG (large cap CEF), TYG (undervalued energy fund), and WIW (inflation protection fund). But this is your investing adventure; you do you.

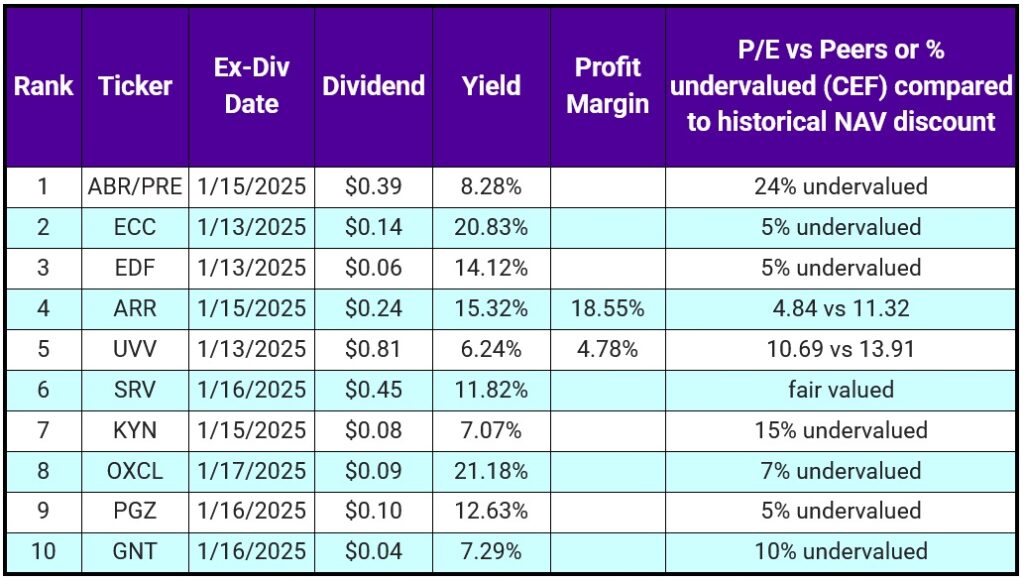

January 13th to 17th

This week is the attack of the CEFs with 7 making the list. Because the market is getting over-valued in a lot of sectors, you should get familiar with how to calculate valuations on CEFs and preferred shares since they’re a good option to invest in — just saying.

ABR/PRE is a different way to invest into ABR (one of our favs). But because it’s a preferred, it has a set NAV price. This makes it easy to see that it’s current value makes it a steal.

If you don’t know or need a reminder on how we calculate valuations on CEFs, check out this video.

For the CEFs, we have a wide net cast here from financial (ECC and OXCL) to emerging markets (EDF) to midstream oil (SRV) to infrastructure (KYN) to real estate (PGZ) to natural resources (GNT).

Basically, choose your own adventure for investing week. What do you think is going to pop off in 2025? I think financials and energy are both good ideas, so ECC, OXCL, SRV and KYN would be my picks.

We only hold SRV from this list, but we have held ECC, EDF, ARR, UVV and OXCL previously. I like them all for different reasons, but when you don’t have enough money to go around, you have to pick and choose. These yields are nice and juicummy if you have free cash.

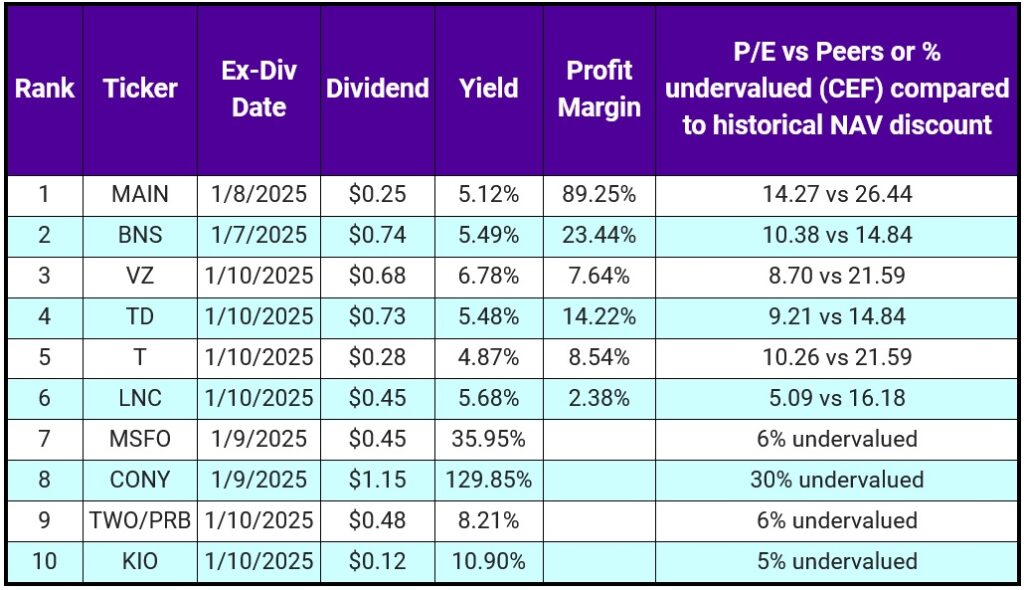

January 6th to 10th

Kind of a boring ass chart this week… lame 😜

We hold MAIN, VZ, MSFO and CONY, making that green in all 4.

If you haven’t invested in at least 1 YieldMax ETF, after all my babbling, what are you waiting for!? If you are interested in CONY at all, now’s the time to get off the side lines.

We started running an experiment with CONY last month by taking out a loan to buy some shares. The idea is to repay the debt with the dividend payouts. This essentially gives you free shares by the end of the year without having to work to buy the investment.

This particular YieldMax ETF has been getting pounded. We’re down a whopping 21.6% in value since we bought in. But this makes buying now all the more juicy, so Carm just decided to move all of her savings out of Worthy to buy shares, swapping 7% yield for 100%+.

CONY’s a steal and won’t be for long. If you’ve been waiting for a sign, here it is. 🚀🚀🚀

Remember, the safest way to guarantee that you make money on YieldMax is to take the dividend in cash and “pay off” your initial investment before you turn the DRIP on.

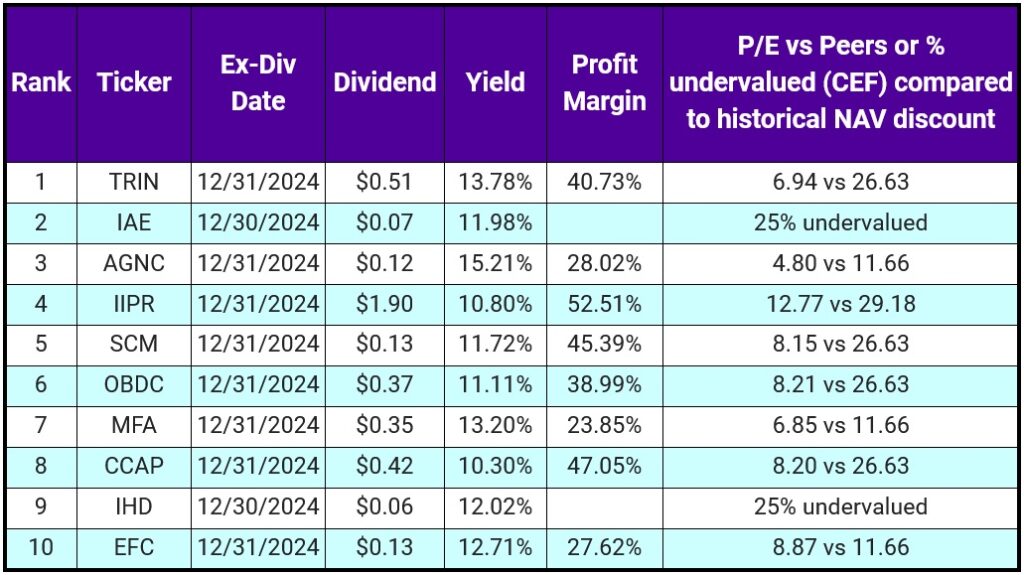

December 30th to January 3rd

22 stocks met my criteria this week, but only 10 could make it to awesomesauce status. It wasn’t easy to narrow these down. You’re welcome.

We have emerging markets exposure with the CEFs of IAE and IHD. I think both should be very, very yummy for 2025 and 2026.

IIPR is super undervalued right now. But, this is because one of their tenants defaulted on their lease. The stock dropped like 40% which is absurd when the tenant only accounts for 14% of IIPR’s revenue. If you have the money, I’d seriously consider picking this one up as it now yields 10%. To put that in perspective, I thought IIPR was hot shit when it yielded 7%.

We hold TRIN, IIPR, and AGNC in our portfolios, but all these stocks rock and produce oodles of income. Basically, throw a dart at this list and you’ll make some serious cash. 💥🤑